This article should be read in conjunction with:

Overview

When logging payments which feature Withholding Tax (‘WHT’) deductions the following steps should be followed:

- Go to the Booking to which the payment relates

- Click on the ‘Log Payment’ option in the right-hand side bar

- Enter the date the payment was received

- Zero out the value of any service line(s) which do not relate to the payment you are logging

- Leave the gross value of the service line(s) you are accounting for unchanged so that the total shown in the top right equates to the sum of the net payment you have received plus the amount of WHT being paid on to the relevant tax authority

- Then click into the relevant service line(s) and add the WHT as a ‘Promoter Deduction’ entitled either ‘Withholding Tax’ or ‘WHT’ so that this information is properly recorded for the purposes of either certain exports and/or statement documents (*)

- If appropriate, additional ‘Promoter Deductions’ can be added for instance if bank charges, flight costs or other deductions apply

- Click ‘Save changes’

- It’s important to record WHT using one of the two naming conventions listed above you can add a suffix such as ‘@XX%’ or ‘a prefix such as ‘XXX State’ to the Promoter Deduction

- This procedure can also be followed using the Agency Deduction option instead of a Promoter Deduction if, for any reason in your territory that you are responsible for deducting WHT

Example

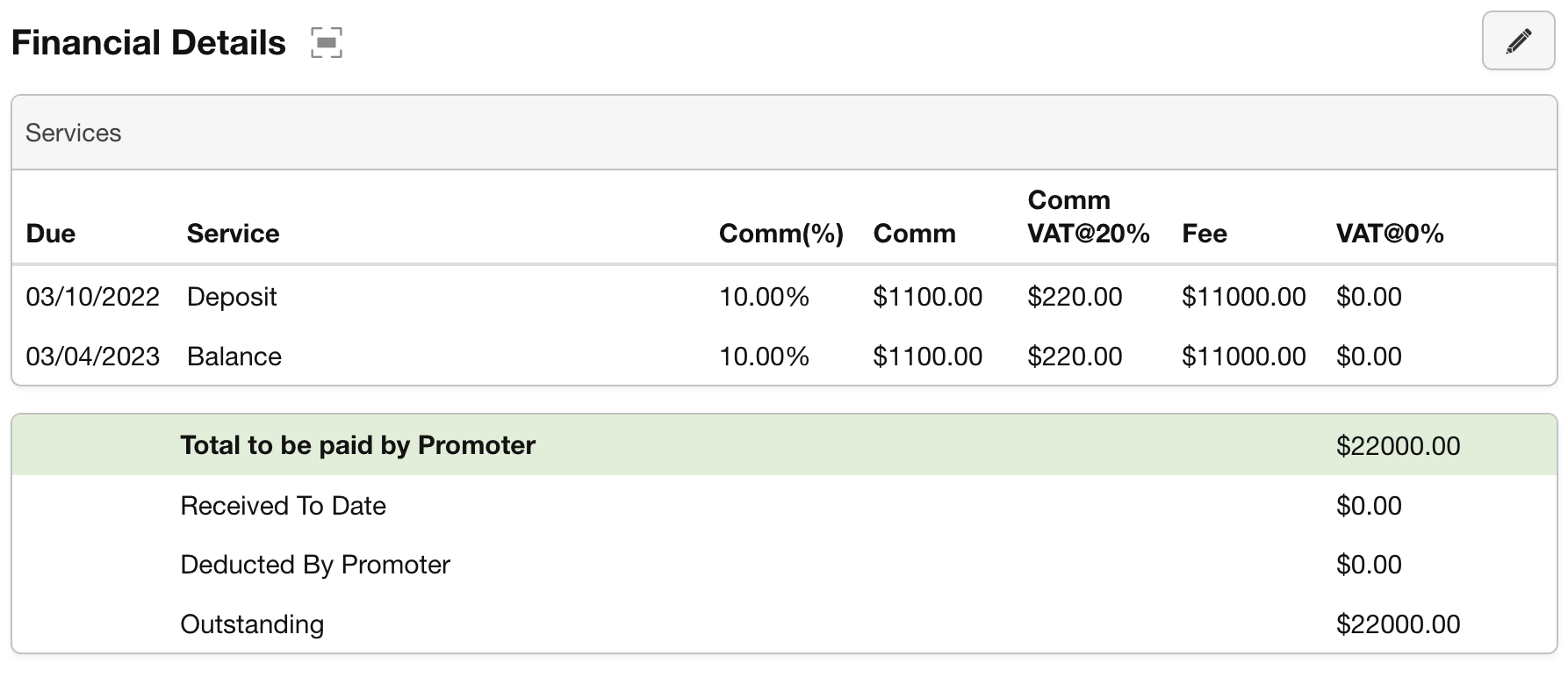

If you contracted an engagement for an Artist subject to WHT @15% for USD 22,000 split into a 50/50 Deposit and Balance.

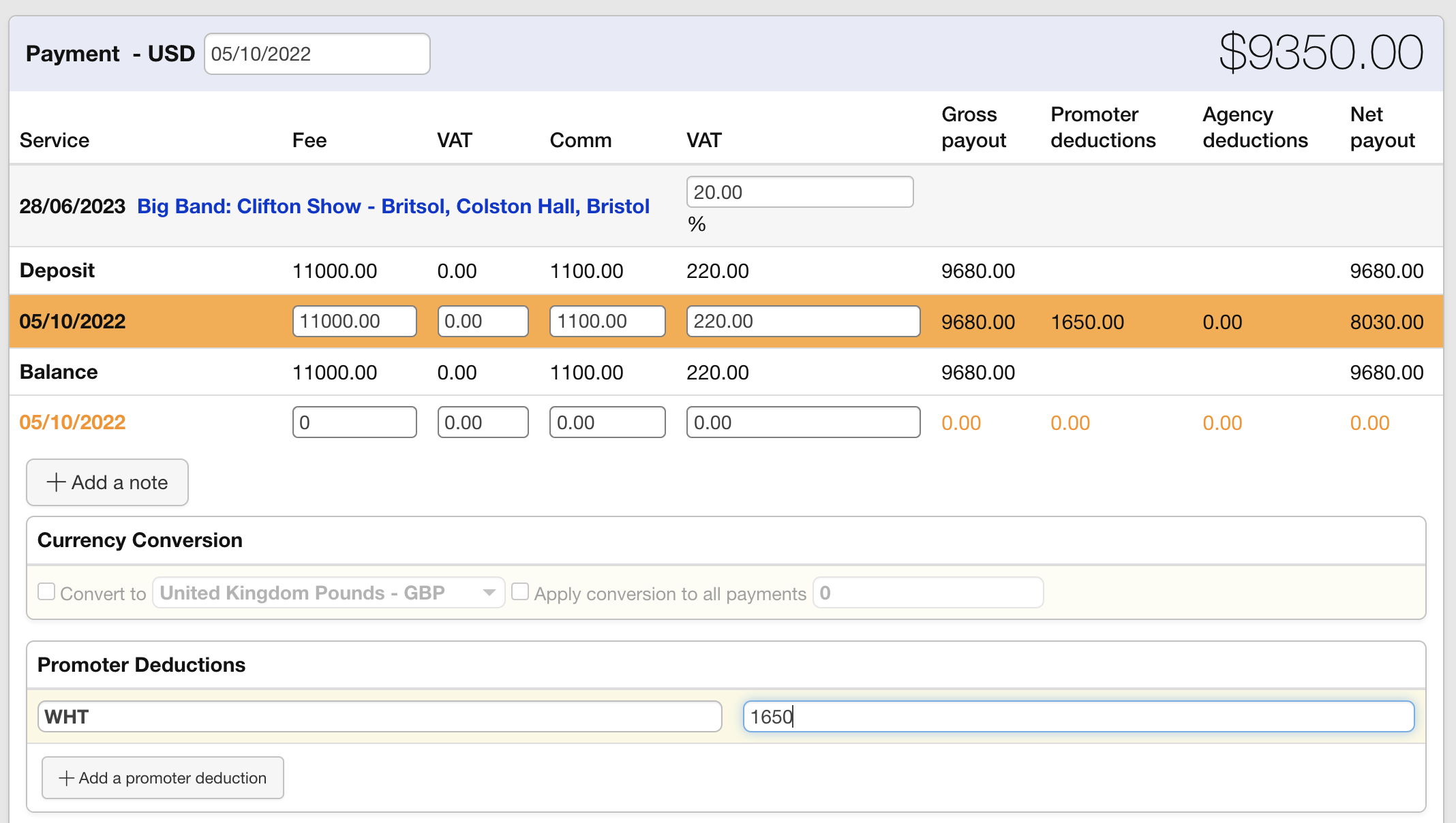

and the Promoter pays the deposit less WHT on a particular date then you would go to the Booking, enter the payment date, zero out the ‘Balance’ service line, leaving USD 11,000 showing in the top right.

You then click into the ‘Deposit’ payment line and chose the ‘Promoter Deduction’ option shown below. On that row you add ‘WHT’ or ‘Withholding Tax’ and the sum of USD 1650 as the amount. This will leave USD 9350 as the net sum received (shown in the top right).

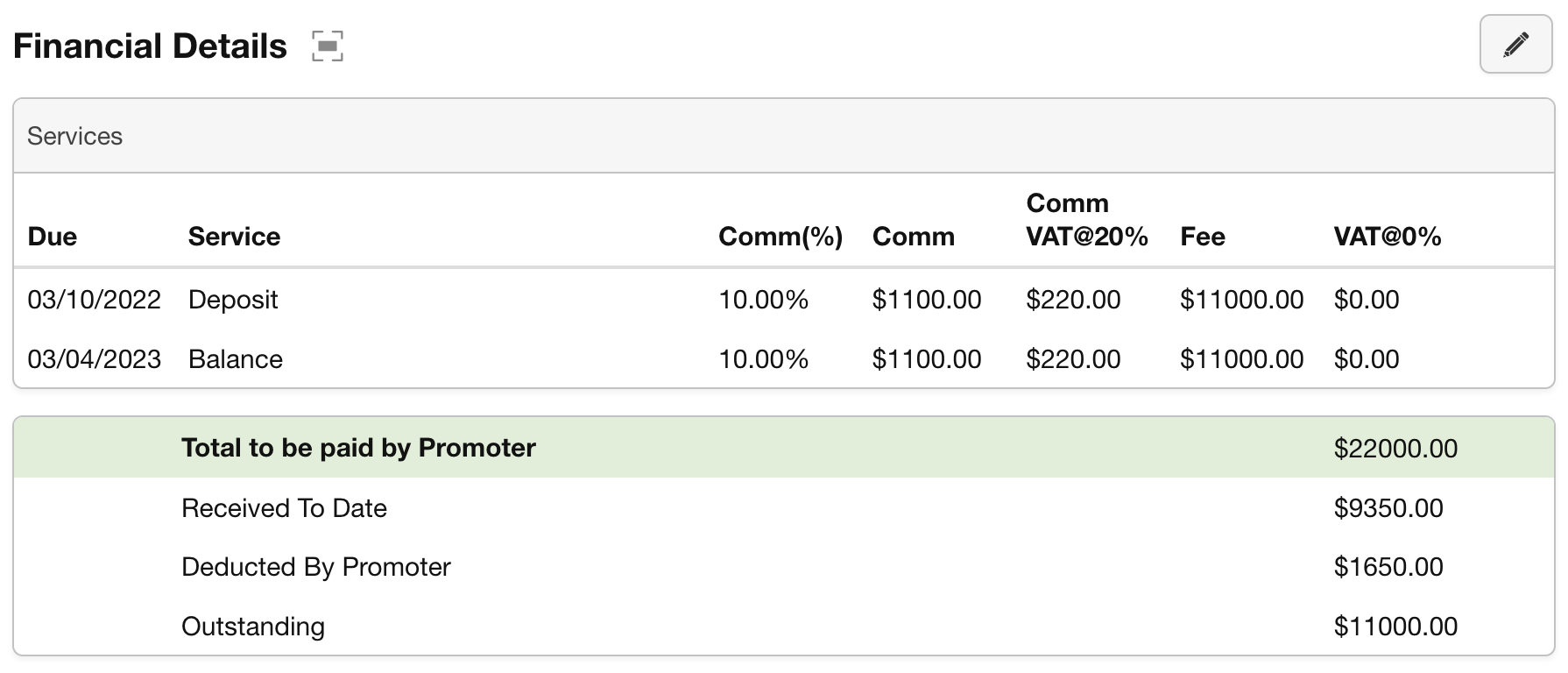

Click ‘Save changes’ and that is both the payment and the WHT logged.

Note: We recommend that WHT is not shown on the face of invoices.

Instead, we recommend that WHT is referenced on contracts or covering emails, as a separate item to the overall fee/payment breakdown as appropriate.

This is because WHT remains part of the fee – it is simply being paid on behalf of the Artist to the relevant tax authority.

If you do choose to show WHT on the face of invoices using either a negative Service line or an Expense, then the relevant entry will need to be removed before the payment is logged.

IMPORTANT: Reporting set-up and use of statements varies from account to account. Further information can be requested by enquiring via support@curiousferret.com